The National Taipei University of Technology (NTUT) has announced a new collaboration with the cryptocurrency company Tether to enhance its blockchain and digital asset education programs. This partnership, unveiled on June 19, aims to provide students at Taipei Tech with a comprehensive understanding of the technology and practical skills in the field.

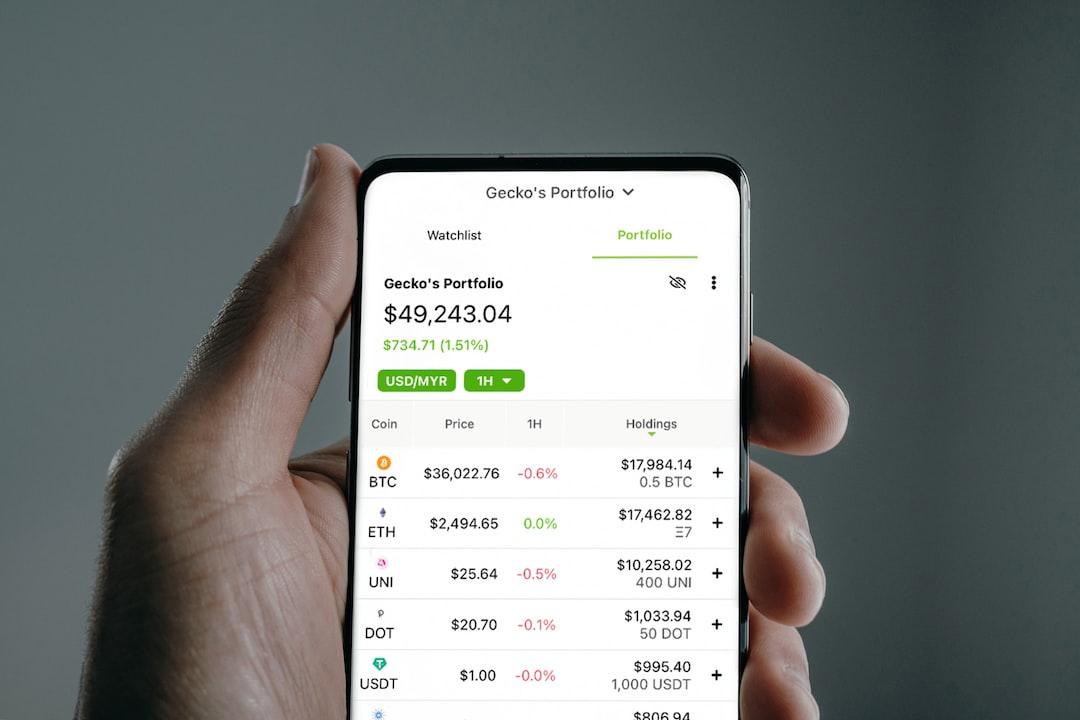

The initiative will focus on educating students about various cryptocurrencies and digital assets, including Bitcoin (BTC) and Tether’s stablecoin (USDT). The program, titled “Blockchain & Digital Asset,” was initially introduced in NTUT’s College of Management and has quickly become one of the most popular courses in the Information and Finance department, with over 110 students enrolled.

The success of the program has generated interest from other universities looking to collaborate with Tether on similar educational initiatives. Tether and NTUT also plan to equip students with the ability to analyze and assess cryptocurrency information independently to identify scams and potential risks.

In addition to understanding the technology behind digital assets, students will learn about the volatility of speculative assets, how to avoid scams, compliance procedures, and potential career opportunities in the industry. Paolo Ardoino, the CEO of Tether, stated that the goal of the partnership is to empower students to promote digital asset adoption in Taiwan.

Stablecoins, such as Tether (USDT), have been a significant topic of discussion in the cryptocurrency industry. Uphold, a digital asset exchange, recently announced that it would be delisting several stablecoins for European users to comply with local regulations, including Tether (USDT). However, data has shown a significant increase in the volume of stablecoin transfers over the past four years, indicating a growing adoption of cryptocurrencies and industry maturity.

Jeremy Allaire, the CEO of Circle, which operates the stablecoin USDC, expressed optimism about the future of crypto and stablecoins. He believes that stablecoins will account for 10% of the money supply in the next decade. In a related note, Conor Daly, the Indy 500 driver sponsored by Polkadot, shared his surprise that his father holds DOT, indicating the widespread interest in digital assets.