Following a brief flirtation with the $63,800 mark on July 1st, Bitcoin (BTC) underwent a notable downturn, bottoming out at $56,746 on July 4th. This three-day decline marked an 11% drop from its peak. Despite attempts to reclaim the $58,000 level, Bitcoin’s price remains 21.5% below its all-time high of $73,757 set on March 14th.

Nevertheless, the resilience in Bitcoin derivatives and stablecoin demand in China suggests that traders are resilient, hinting at a potential continuation of the bullish trend in 2024.

Bitcoin’s decline contrasts with the S&P 500 and gold nearing their respective record highs.

The S&P 500 achieved a new peak on July 3rd, while gold is less than 4% away from its record $2,450 high on May 19th. The stock market surge is fueled by better-than-expected corporate earnings and anticipations of interest rate cuts by the US Federal Reserve in 2024. This underscores that the downturn in cryptocurrencies isn’t tied to broader demand for riskier assets or alternative investments.

Furthermore, the US 5-year Treasury yield has remained stable at 4.33% for the past month, indicating no significant movement towards “flight-to-quality” assets where investors typically seek safer havens. Typically, this would lead to lower yields as demand for government bonds rises amidst inflation concerns, but recent trends fail to support this, leaving Bitcoin’s 19% decline over four weeks without backing from broader macroeconomic shifts.

Despite considerable selling pressure, Bitcoin whales and market makers have displayed resilience, as evidenced by key metrics in the derivatives market.

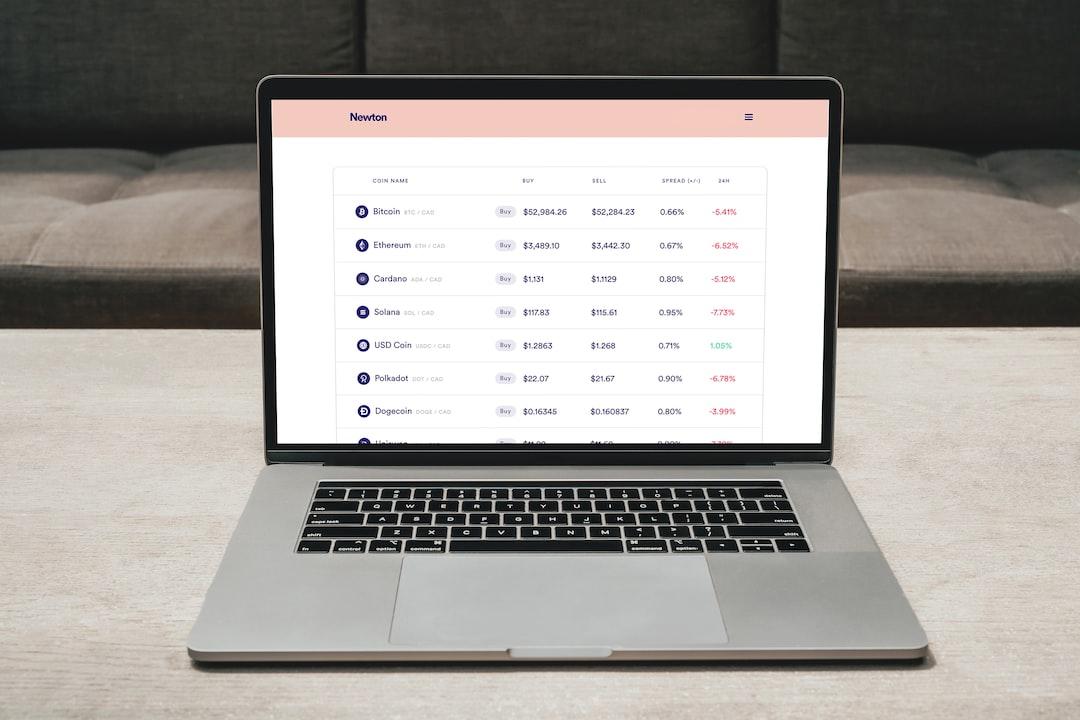

Bitcoin derivatives metrics remain neutral as demand for stablecoins rises in China.

Professional traders often favor monthly contracts due to their lack of funding rates. In neutral markets, these contracts typically trade at a 5% to 10% premium to account for longer settlement periods.

Data shows that the BTC futures premium dropped to 7.5% on July 4th but remains within neutral territory. It briefly exceeded the bullish threshold of 10% on July 2nd, lasting less than four days. The current futures premium closely resembles the period from June 21st to June 24th following a 12-day correction where prices dropped by 15%.

Additionally, options markets provide insight into investor sentiment. A delta skew metric above 8% indicates a bearish outlook, while below -8% suggests optimism.

Currently, the BTC options 25% delta skew stands at 0%, indicating balanced pricing between call (buy) and put (sell) options. This reflects decreased confidence compared to the previous week’s -5%, but still falls within neutral range, suggesting no urgent demand for hedging through Bitcoin options.

To gauge if the reduced interest in Bitcoin futures mirrors broader market sentiment, one can look at the demand for stablecoins in China. Typically, strong retail demand for cryptocurrencies causes stablecoins to trade at a premium of 2% or more above the official USD rate, whereas a discount often signals bearish markets.

The premium for China’s USDC stablecoin fell below 1% on June 28th, indicating a rush to liquidate cryptocurrency holdings. However, this trend reversed on July 4th with the premium returning to a more neutral 1.8%, suggesting increased buying activity as traders convert fiat CNY into stablecoins.

Given the absence of bearish signs in Bitcoin derivatives, this data boosts confidence that BTC may soon reclaim the $60,000 support level.

This article does not offer investment advice or recommendations. All investment and trading decisions carry risks, and readers should conduct their own research before making any decisions.