Bitcoin miners are about to face a significant change in their rewards as the highly-anticipated “halving” event approaches. This event, which aims to combat inflation, is expected to take place around April 17, 2024. While this is not the first halving event, the current state of the crypto world, with its record-breaking prices and crowded mining industry, adds an air of mystery and suspense to what could be a pivotal moment in cryptocurrency history.

Leading up to the halving, there have been notable developments in the industry. The United States has approved its first-ever spot Bitcoin exchange-traded funds, marking a significant milestone. Furthermore, on March 13, 2024, Bitcoin reached an all-time high price of $73,679. The big question now is what will happen to the price after the halving event in April. Will it decrease, skyrocket, or remain stable? The future is uncertain, but looking at past halving events can provide some insights into what might unfold this year.

Let’s delve into the historical data. The first Bitcoin block was mined on January 3, 2009, with a reward of 50 BTC. The first halving occurred on November 28, 2012, reducing the reward to 25 BTC per block. At that time, the price of BTC was around $12.20. Here’s an interesting fact: if someone had invested $100 in BTC on the day of the first halving, they would have acquired 8.9 BTC. If they had held onto their coins until March 13, 2024, when BTC hit its most recent all-time high, that $100 investment would have grown to $655,743.

Following the first halving, the price of BTC surged from $12.20 to approximately $1,000 by the end of 2023. The second halving took place on July 9, 2016, reducing the mining reward to 12.5 BTC per block. Bitcoin was valued at around $640 during that time, but by July 2017, it had risen to $2,550. The third and most recent halving event occurred on May 11, 2020, reducing the mining reward to 6.25 BTC per block. At that time, Bitcoin was trading at around $8,750. Within a year, Bitcoin reached an all-time high of approximately $62,000.

Now, let’s focus on the upcoming halving in 2024. The anticipation surrounding this event has driven both the price of BTC and speculation to all-time highs. Analysts have made various predictions, ranging from a price of around $75,000 immediately after the halving to $250,000 or more within a year. While history suggests that BTC prices tend to skyrocket after halvings, there have been periods of drawbacks and recessions between the halving and the upward momentum.

It is crucial to note that predictions about market movements are just that – predictions. No one can say for certain whether Bitcoin will decline, surge, or stabilize after the halving. However, historical trends seem to favor upward momentum, with all-time highs often following halving events.

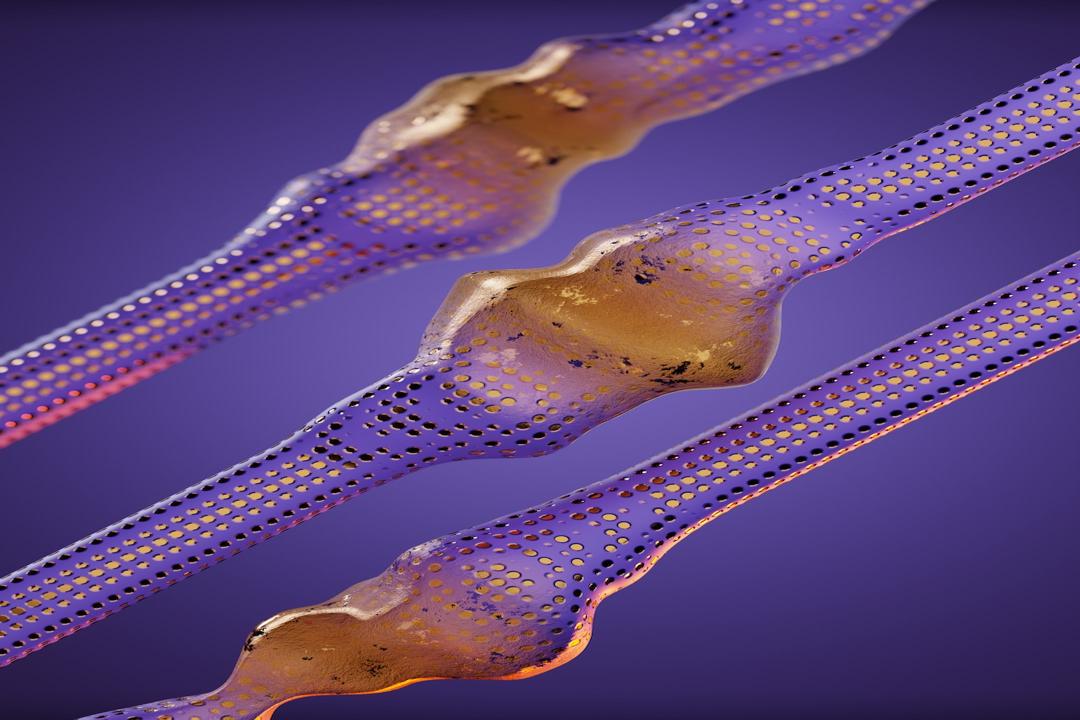

Apart from price concerns, there are also unanswered questions about network security in the post-halving world. One potential issue is the security risks associated with smaller miners being pushed out of the market due to the 50% reduction in rewards. Miners who operate on the brink of profitability may find themselves unable to compete and may need to sell off their equipment or exit the industry altogether. This could cause fluctuations in mining availability, impacting hash rates and overall network security.

On the flip side, previous halving events have had minimal impact on network security. Many analysts predict a smooth sailing for the Bitcoin network in terms of security.