In a classic bull market move, an individual involved in the world of cryptocurrency has recently made headlines for spending an astonishing $113,000 in gas fees while attempting to acquire $26,000 worth of a newly released token.

Unfortunately, this investment did not go as planned, as the token in question turned out to be a scam and lost its value within just 35 minutes.

According to transaction data from Etherscan, a single wallet address engaged with a smart contract address on February 13th, transferring 10 Ether (ETH) worth approximately $26,000 to the contract. The smart contract then converted it into Wrapped Ether (WETH) and executed a swap for 30 No Handle (NO) tokens, which were newly listed ERC-404 tokens. The proceeds from this transaction were then deposited into another wallet address.

The transaction, as reported by Web3 portfolio tracker DeBank, incurred a total gas fee of 42.8 ETH, which is equivalent to $113,211.

Some individuals perceive extravagant spending on gas fees as a sign of a bull market, where users take risks in the hopes of making substantial returns on lesser-known tokens.

DeBank reveals that the wallet in question seems to be the initial caller of the smart contract.

Unfortunately for the user, the price of a single NO token skyrocketed from $6.80 at launch to an astonishing peak of approximately $70,000, only to crash back down to nearly $0 within a span of 35 minutes, according to data from Dex Screener.

Lookonchain described the user as being “rugged” when the NO token’s price abruptly dropped to almost zero.

Dex Screener data shows that the price of the NO token fluctuated from $6 to $70,000 and then back to $0 in less than 40 minutes.

Additionally, the NO token has received a safety score of 0 out of 100 and has been labeled as “high risk” by blockchain analytics service Crypto Monkey. In a post on February 13th, Crypto Monkey informed users that the token’s contract had not been renounced and that only two addresses held 90% of the token.

Related:

The blockchain community is divided over the introduction of new ERC-404 tokens.

It remains unclear whether the user was attempting to take advantage of the token’s launch or if it was simply a mistake when interacting with the smart contract. However, the high gas priority fee suggests that the former is more likely.

The wallet address has been actively capitalizing on the growing ERC-404 trend, earning over $1.1 million in profit from Pandora tokens. Pandora was the project that kickstarted the ERC-404 frenzy after its launch on February 5th.

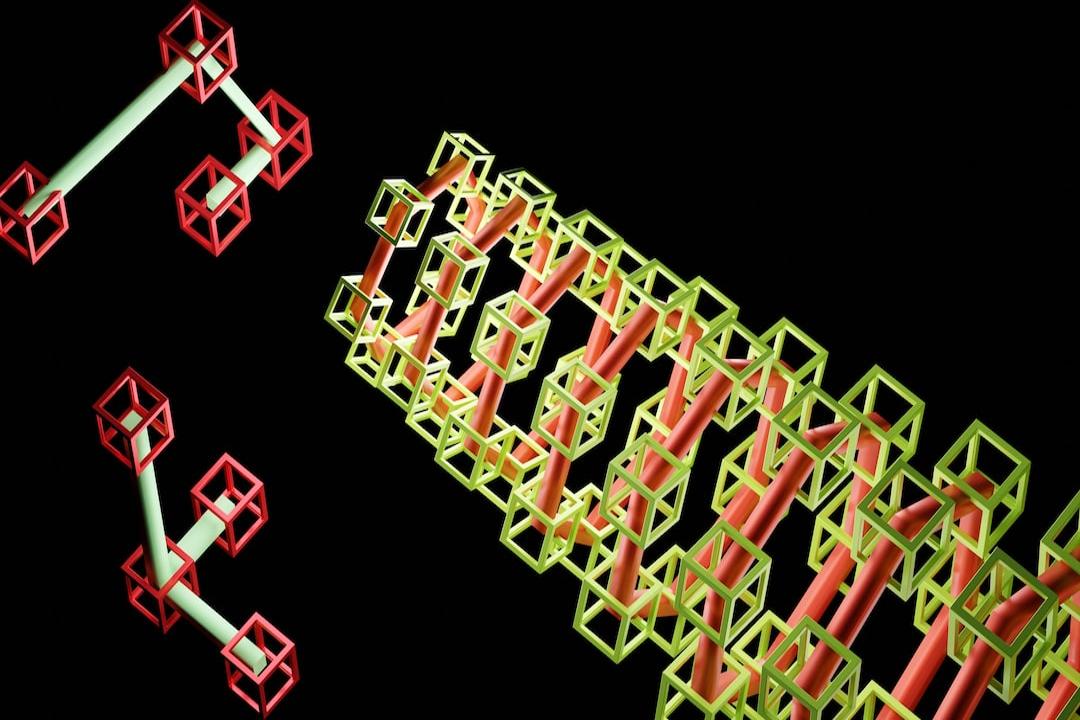

ERC-404 is an unofficial and experimental token standard that aims to connect ERC-721 nonfungible tokens (NFTs) with ERC-20 tokens. This allows for the creation of fractionalized NFTs, where multiple wallets can own a portion of a single NFT and use that portion for trading or staking as collateral for loans.

Magazine:

Real-life Doge at 18 — Meme that’s going to the moon